According to the Confused.com Car Insurance Price Index that is produced in association with Willis Towers Watson, motorists will be disappointed to read that, in the first quarter of 2017, fully comprehensive car insurance premiums rose. This has been a trend for quite some time and it remains to be seen when it will end.

According to the Confused.com Car Insurance Price Index that is produced in association with Willis Towers Watson, motorists will be disappointed to read that, in the first quarter of 2017, fully comprehensive car insurance premiums rose. This has been a trend for quite some time and it remains to be seen when it will end.

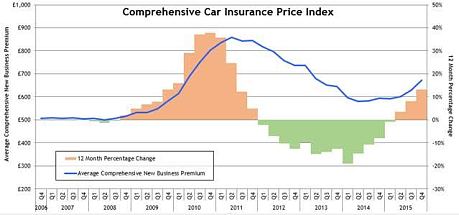

Such premiums have increased by an average of 16% in the 12 months to 31st March 2017. In monetary terms, this equates to an average rise of £110 per annum that is no small sum. In fact, there has been an average increase of 2% per annum in the first quarter of this year with this equating to an extra £14 per annum. The cost of providing such cover at the end of the first quarter of 2017 had reached an average of £781 per annum.

Regrettably, every UK region saw an increase in premiums over a period of 12 months with the biggest percentage rise being in the Scottish Islands and Highlands that saw a rise of 21%. The Scottish Borders saw an increase of 19% but, interestingly, premiums in that region are still the lowest in the UK averaging £547 per annum.

Those motorists living in Inner London have seen their fully comprehensive car insurance premiums increase by an average of £174 per annum to £1,260 per annum in the 12 months to 31st March of this year. That equates to a rise of 16%. The South West saw an annual rise of 15%  although in the first quarter of 2017 the average premium in that region actually dropped by £1 per annum.

although in the first quarter of 2017 the average premium in that region actually dropped by £1 per annum.

It is 66 year olds who have been subjected to the largest percentage increase with car insurance premiums going up by 23% in the last 12 months. The lowest increase in percentage terms was for 18 year olds who saw their premiums rise by an average of 9% although it is that age group who pay more for their motor insurance than anyone else with premiums being an average of £2,164 per annum.

With the cost of covering your car going up it is important that you shop around for a competitive deal. In that respect, why not speak to one of our experienced members of staff on 02380 268 351. AIB Insurance has access to an extensive panel of insurers and can help arrange cover on various makes and models of vehicle.

Whilst motorists have benefitted from a significant drop in fuel prices in recent months there has been a progressive increase in car insurance premiums in 2015. This is borne out by the Confused.com Car Insurance Price Index that is powered by Willis Towers Watson.

Whilst motorists have benefitted from a significant drop in fuel prices in recent months there has been a progressive increase in car insurance premiums in 2015. This is borne out by the Confused.com Car Insurance Price Index that is powered by Willis Towers Watson.

You must be logged in to post a comment.